Kinetica, provider of the world’s fastest GPU-accelerated relational database, today announced it has closed a $50-million Series A financing. The round was co-led by Canvas Ventures and Meritech Capital Partners, with participation from new investor Citi Ventures and existing investor Ray Lane of GreatPoint Ventures.

“We invested because we believe in the promise of Kinetica in the commercial world,” said Gary Little, partner at Canvas Ventures. “But understanding Kinetica’s US-intelligence community roots will shed light on how ground-breaking their technology truly is. In 2009, Kinetica co-founders, Amit Vij and Nima Negahban, were hired by the United States Army Intelligence and Security Command and the National Security Agency (NSA) to create a system to track and capture terrorists in real time. No database existed in the market that could meet the Army’s demands. So they built a new class of enterprise-grade SQL database from the ground up, powered by GPUs, that could provide instant results and the ability to visualize insights across massive, streaming datasets. Today, the company is on their 6th product release with customers such as the United States Postal Service and major Fortune 500 brand names. This is no ordinary Series A company.”

Asked to further describe how Kinetica was used by the US Army and the NSA, Kinetica Co-Founder and CEO Amit Vij said: “At the time, our database ingested data from more than 200 different streaming big data feeds. This included drones that tracked every asset that moved at 30 frames per second; mobile devices that emitted their metadata every few seconds; social media like Twitter and Facebook; and cyber security data. We were evaluating billions of signals to find that needle in the haystack.”

“Now imagine this powerful analytics database at work in banks, oil and gas, automotive, healthcare, telecom, airline, logistics and delivery, and retail and ecommerce companies,” said Paul Madera, partner at Meritech Capital Partners. “These and other types of enterprises will profit from making rapid decisions using the totality of their data – including hundreds of terabytes of streaming and unstructured data. What excites me is how broadly applicable the Kinetica database is.”

Kinetica customers include GlaxoSmithKline, PG&E, US Postal Service, IronNet Cybersecurity, and one of the world’s largest retailers. Kinetica estimates their total addressable market to be approximately $30 billion using Gartner’s 2017 Q1 forecast for enterprise software*.

“Our goal is to extend the use of our product at Fortune 2000 companies and to other businesses that would like to glean real-time insights in the fastest possible way from the data sources they have today and any kind of data in the future – including data generated from sensors in cars, appliances, banking systems, medical devices, and data sources not yet imagined,” said Amit Vij.

In conjunction with the financing, Gary Little and Paul Madera will join Ray Lane, Amit Vij, and Nima Negahban on Kinetica’s Board of Directors.

Amit Vij added, “In my opinion, Kinetica’s investors are the most experienced database experts in venture capital. They include: Ray Lane who served as president and COO at Oracle for eight years; the founders of Canvas Ventures, who prior to launching Canvas co-founded Ingres Corporation and Illustra Technologies as well as funded TimesTen during its early venture round; and the partners at Meritech who invested in Netezza and Greenplum. We’re thrilled and humbled by their enthusiasm in our vision.”

Inclusive of this $50-million Series A funding round, Kinetica has raised a total of $63 million in venture financing. The company will use their new funding to hire additional engineering, sales, and marketing talent as well as open new offices worldwide.

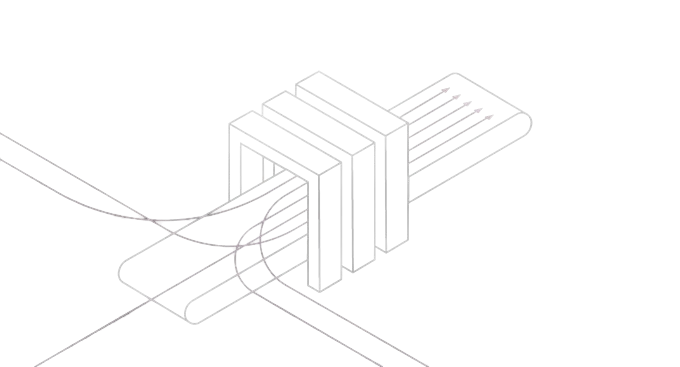

More About GPU-Accelerated Databases

In general, GPU-accelerated computing is the use of a graphics processing unit (GPU) together with a CPU to run applications much faster. A GPU is hardware; a specialized device located either on dedicated plug-in cards, or integrated into the circuitry of the motherboard or the CPU itself. GPU computing is well suited to performing repeated, similar instructions massively in parallel. This makes them ideal for the compute-intensive workloads required of large data sets. In the case of Kinetica, the software application being accelerated by GPUs is a database. Legacy databases, like Oracle and SAP HANA, do not run on GPUs.

More Perspectives on Kinetica and Industry Trends

Keith B. Alexander, a retired four-star general of the United States Army who served as Director of the NSA, said, “We posed what must have seemed to be a daunting technical challenge to Amit and Nima back in 2009. They rose to the occasion and developed the precursor to what you see today as the Kinetica database platform when every other commercial and open-source solution failed to meet the mission objectives. They are an example of brilliant technical minds putting their talents to work in service to our country.”

Said Ray Lane, partner at GreatPoint Ventures, “Kinetica’s market potential is enormous. As the Internet of Things, machine learning, and artificial intelligence continue to grow, so will the demand for GPU databases. As for the product, calling Kinetica a database is an understatement. They have created a database platform that acts as a data warehouse with advanced analytics and visualization. It is optimized for running machine learning and deep learning models. And it is the first GPU database to do all this on a single platform that can ingest massive datasets and respond to queries simultaneously. Using traditional methods, a customer would typically need to integrate several technologies, like an SAP or Oracle database, SAS analytics software, or TensorFlow, an open-source software library for machine learning. Other technologies can present visual data, but they require much longer processing time. Customers often end up duct-taping multiple technologies together that are loosely coupled. With Kinetica, it’s a single solution. You can run simple SQL statements on billions of rows and get instant, visualized results in sub-second time. The Kinetica database allows a customer to be up in production quickly, and run queries and analytics that are impossible to do on other databases.”

Said Gary Little, partner at Canvas Ventures: “In comparison with traditional databases provided by vendors like Oracle, SAP, and Teradata, Kinetica provides 100x the performance at one tenth the hardware cost. Kinetica’s database can run well on industry-standard GPU-enabled hardware, whereas legacy databases cannot. Also in Kinetica’s favor is a trend where GPUs are increasingly being adopted by public cloud and private data centers globally. And if you’re looking to compare Kinetica to other GPU databases, you’ll see Kinetica enjoys strong first-mover advantage and is years ahead of their competition. None of the followers have achieved feature parity.”

How Kinetica Is Being Used Today

- Real-time risk exposure and fraud detection for financial assets (banking customer)

- Smart-grid infrastructure management (utilities customer)

- Real-time supply chain and inventory management (retail and ecommerce customer)

- Genomics research (healthcare customer)

- Real-time location-based analytics for route optimization (logistics and delivery customer)

- Real-time drilling and well analytics (oil and gas customer)

- Counterterrorism and cybersecurity (multiple customers)

- Advanced analytics and OLAP data processing (multiple customers)

- Optimized platform for deep learning and machine learning (multiple customers)

- Data warehouse for both traditional and non-traditional data like data from Internet of Things and social media (multiple customers)

- Accelerating popular BI analytics visualization tools such as Tableau and Power BI (multiple customers)

Kinetica Company Milestones

- Patent received in 2011

- Deployed at the US Army Intelligence and Security Command in 2012

- Commercialized and launched at the United States Postal Service in 2014

- Kinetica’s deployments have been recognized with two prestigious IDC awards for “High Performance Computing Innovation Excellence” in 2014 and 2016

- Launched Kinetica version 6.0 in 2017

- 75 employees worldwide, located in San Francisco; Arlington, VA; and London

- Amazon Web Services, Google Cloud Platform and Microsoft Azure all bring GPU instances to customers deploying Kinetica in the cloud

- Meets sophisticated analytics needs with GPU-accelerated algorithms from Fuzzy Logix, and runs machine learning libraries such as TensorFlow, Caffe and Torch to speed model training and deployment

- A strong partnership with NVIDIA for accelerated hardware; and certifications on Cisco, Dell, HP, IBM, and Supermicro servers to ensure enterprise-readiness

- Total venture funding to date: $63 million

About Canvas Ventures

Canvas is a respected early-stage venture capital firm based in Portola Valley, CA. The partners are known for notable investments in software & services companies. Prior to joining Canvas, the firm’s partners invested in MuleSoft, Lending Club, Houzz, Evernote, NexTag, Check, Doximity, Elance-oDesk, and more. They are “thesis investors” and currently concentrate on the areas of artificial intelligence, “new enterprise” solutions, fintech, health IT, and marketplaces. The Canvas partnership was formed in August 2013. FutureAdvisor is a prior Canvas investment which was acquired by BlackRock in 2015. Current Canvas portfolio companies include: Eden, Everwise, Casetext, CrowdFlower, Fluxx, Folloze, HealthLoop, Hustle, Kinetica, Luminar, Platform9, Totango, Transfix, Vida Health, Viewics, and Zola. More at www.canvas.vc.

About Meritech Capital Partners

Meritech Capital Partners is a leading provider of late-stage venture capital to category-defining private technology companies, and has been one of the top performing venture firms of the past nearly two decades. With $2.1 billion under management, Meritech leads investments into companies with proven and differentiated technology, rapidly-growing revenue and experienced management teams. With one of the most active late-stage venture portfolios, Meritech has experience in and provides guidance on those issues facing rapidly growing private technology companies. Meritech investments in industry-leading companies include Acclarent, Alteryx, Box, Cloudera, Cornerstone-OnDemand, Coupa, Datadog, Facebook, Fortinet, Glaukos, Imperva, Looker, Lynda.com, MuleSoft, NetSuite, Proofpoint, PopCap, Roblox, Salesforce, Tableau and Zulily. Meritech is located in Palo Alto, CA and can be found at www.meritechcapital.com.