MEET THE HOSTS: Nicole Geissler Major Accounts, Financial Services, Kinetica & John Thorpe Sr. Solution Engineer, Kinetica

Financial services organizations managing complex portfolios are faced with understanding billions of market transactions every day, each one with the potential to materially affect the risk exposure of their portfolio. They need to gain real time insight into risk to maximize revenue and minimize downside to meet both business and regulatory requirements.

However, existing risk solutions are reaching their limit due to the speed and scale of market signals. These platforms are built from many different technologies that require complex data engineering to compute risk and lack the ability to run risk models continuously and on-demand.

THIS WEBINAR WE’LL SHARE:

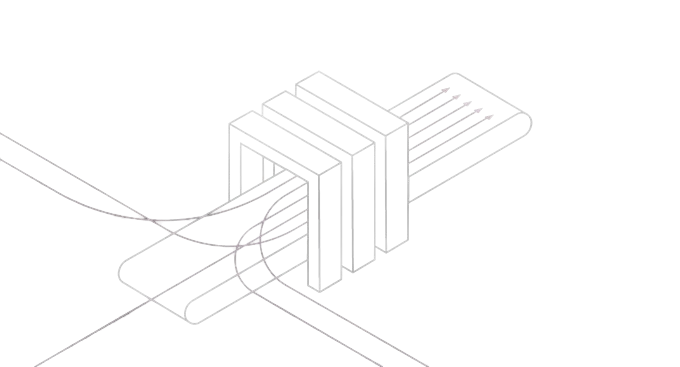

- How Kinetica converges streaming and historical analytics with integrated pricing and risk models in a single platform to unlock real-time portfolio risk analysis and explain…

- The value of moving from passive to active analytics for risk calculations

- An example architecture and demo of active analytics for portfolio risk analysis

- Why Kinetica is trusted by some of the world’s largest financial institutions to accelerate mission-critical financial calculations