For asset managers responsible for balancing risk and opportunity for portfolios of mortgage assets, the ability to blend data sources at scale to gain on demand insight into mortgage performance and trends is incredibly valuable. Rapidly predicting potential mortgage defaults and identifying underpriced mortgages can help organizations to analyze more scenarios and make accurate, data-driven decisions around asset allocation that increase profit.

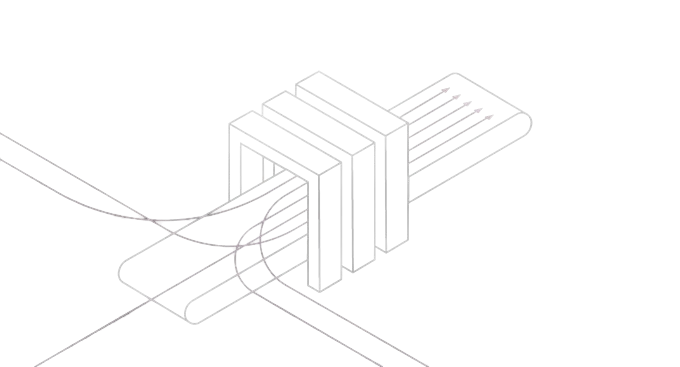

Previously, analyzing large portfolios and applying predictive risk and pricing models required a complex mix of infrastructure for data science and analytics, leading to slow iteration cycles and models with less rich features. Kinetica converges the ability to do advanced analytics and accelerated data science on a single GPU-accelerated data platform.

IN THIS WEBINAR WE’LL EXPLORE:

- How Kinetica enables asset managers to more accurately model, value, and manage mortgage assets, at scale, to gain an edge on the competition and increase profits

- The value of converging fast moving MLS data, historical mortgage data, location analytics, and weekly yield curves, with statistical models on a single platform to gain new insight

- How Kinetica’s GPU-accelerated platform enables the use of NVIDIA RAPIDS to dramatically accelerate model training

- A demo of Kinetica for mortgage risk and opportunity analysis analyzing over 40M loan files and 2B+ monthly performance records and enriched with ever changing treasury yield curves